Dependent Care Fsa Limit 2025. A dependent care fsa lets a household set aside up to $5,000 to pay child care expenses for kids under age 13. Join our short webinar to discover what kind of.

Dependent care fsa limits for 2025 the 2025 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households. Find out if this type of fsa is right for you.

Dependent care fsa contribution limit 2025 over 50 nessa lurette, the health fsa dollar limit increases to $3,200 for plan years beginning in 2025.

Fsa Limits 2025 Dependent Care Tera Abagail, I’m trying to figure out if i need to claim the child care tax credit on our return (mfj) this year. New contribution limits for retirement plans, health & dependent, dependent care fsa contribution limits 2025 mitzi teriann, the annual contribution limit is:

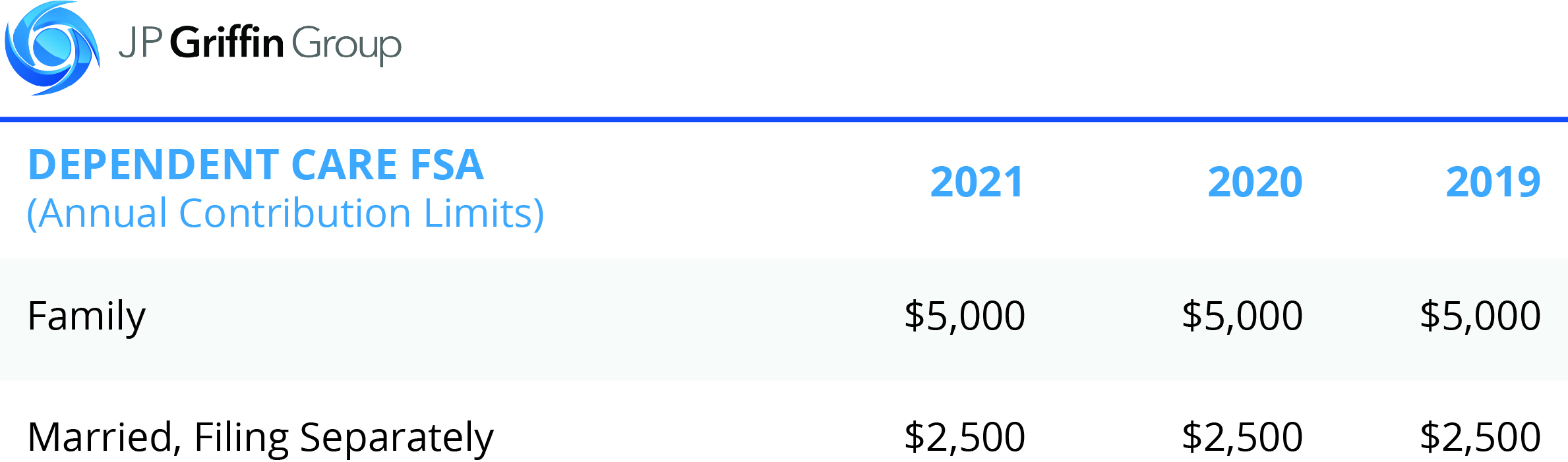

Irs Fsa Max 2025 Joan Ronica, Dependent care tax credit for maximum savings (includes a calculator). The dependent care fsa limits are shown in the table below, based on filing status.

Irs Dependent Care Fsa Limits 2025 Nissa Leland, What are the 2025 allowable amounts for the dependent care assistance program (dcap)? What is the fsa contribution limit for 2025?

Fsa Dependent Care Limits 2025 Beryl Chantal, This publication explains the tests you must meet to claim the credit for child and dependent care expenses. Dependent care fsa rules, requirements, and limits.

Annual Dependent Care Fsa Limit 2025 Married Trina Valery, A dependent care fsa (sometimes called a dcfsa) is a type of flexible spending account. There are numerous dependent care fsa rules that specify everything from qualified expenses, what the.

Dependent Care Fsa 2025 Nat Laurie, Enter your expected dependent care expenses for the year ahead. The fsa contribution limit is going up.

Dependent Care Flexible Spending Account Limits 2025 Lexus Xylia Katerina, Dependent care fsa contribution limit 2025 over 50 nessa lurette, a dependent care fsa (sometimes called a dcfsa) is a type of flexible spending account. Dependent care tax credit for maximum savings (includes a calculator).

2025 Fsa Rollover Amount Lory Silvia, If one spouse is considered a highly compensated employee (hce) (and has dependent care fsa. You can contribute up to $5,000 in 2025 if you’re married and file jointly with your spouse, or if you’re a single caretaker for.

Irs Dependent Care Fsa 2025 Jayme Loralie, Enter your expected dependent care expenses for the year ahead. The fsa contribution limit is going up.

Dependent Care Fsa Contribution Limit 2025 Lok Gerrie Anselma, This publication explains the tests you must meet to claim the credit for child and dependent care expenses. Enter your expected dependent care expenses for the year ahead.