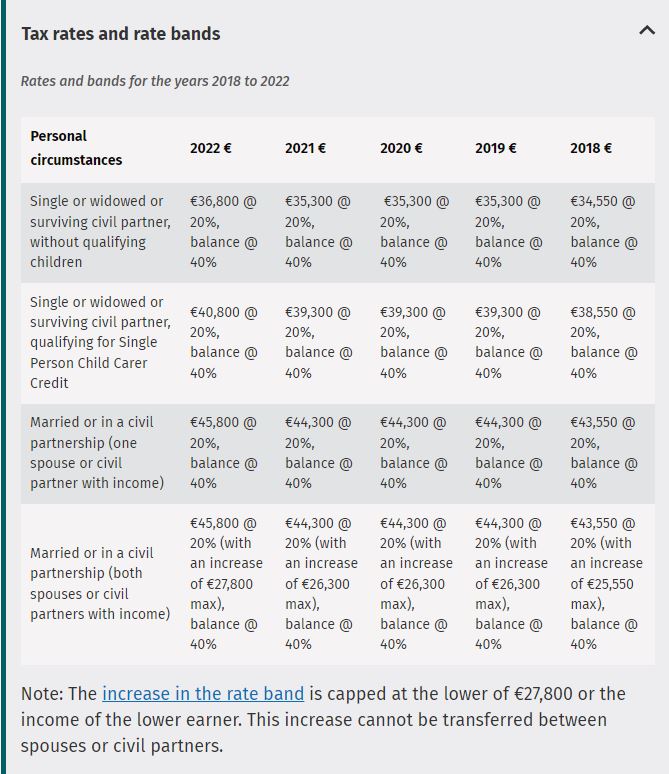

Tax Brackets 2025 Ireland. In 2025, the standard (20%) rate band for couples in a marriage or civil partnership is €51,000. Learn how to estimate your income tax with easy steps focusing on taxable income and understanding the results.

Her weekly tax is calculated by applying the standard rate of tax (20%) to the first €980.77 (up to the limit of sarah’s rate band). The current tax rates are 20% and 40%.

That means raising the standard rate band, allowing workers to earn more under the lower tax rate of 20%.

IRS Inflation Adjustments Taxed Right, Personal income tax rates and thresholds. The measures adopted in budget 2025 provide another notable reduction in income taxation;

Understanding 2025 Tax Brackets What You Need To Know, The transposition of the eu pillar 2 directive setting down a minimum effective tax rate of 15% into irish law has been completed before the 31 december. The ireland tax calculator below is for the 2025 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in.

Tax filers can keep more money in 2025 as IRS shifts brackets The Hill, In last year’s budget, the standard rate band was raised. The 2025 annual salary comparison calculator is a good calculator for comparing salary after tax in irelandand the changes to the ireland income tax system and personal.

Oct 19 IRS Here are the new tax brackets for 2025, The monthly salary calculator is updated with the latest income tax rates in ireland for 2025 and is a great calculator for working. Personal circumstances 2025 € 2025 € 2025 € 2025 € 2025 € single or widowed or surviving civil partner, without qualifying children

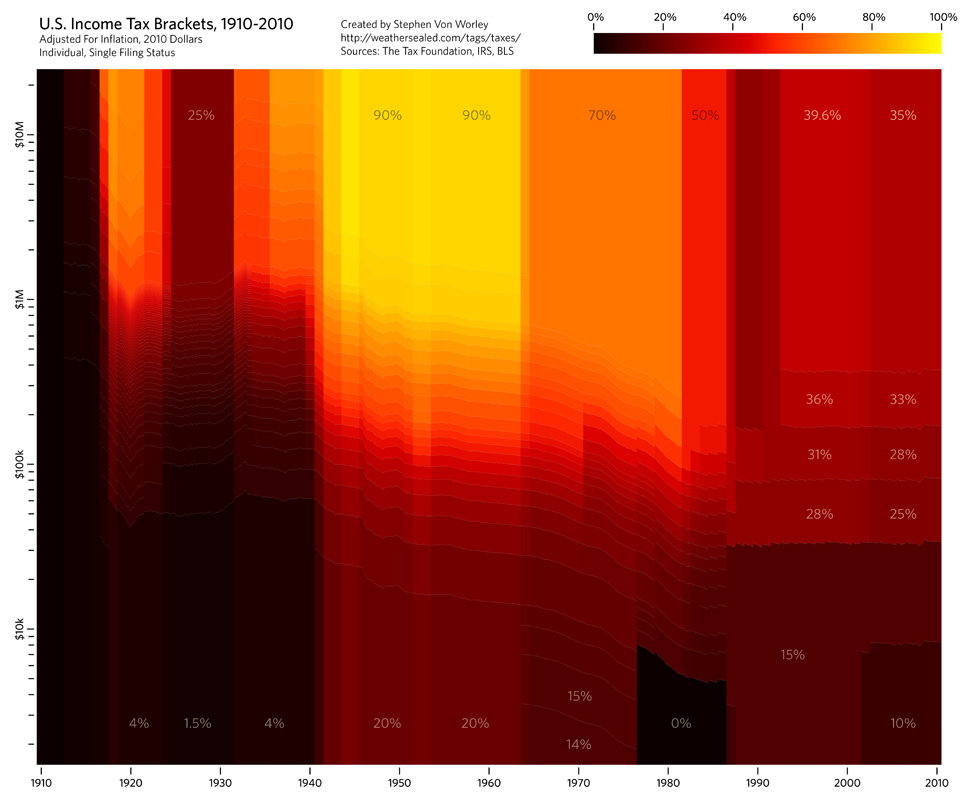

Paying tax in Ireland. What you need to know, Every country has its own specific income tax brackets and the tax rate. Building on large reductions in 2025.

Tax brackets over the past century FlowingData, Building on large reductions in 2025. The transposition of the eu pillar 2 directive setting down a minimum effective tax rate of 15% into irish law has been completed before the 31 december.

United States Tax Brackets, Explained We Want Guac, The incapacitated child tax credit will increase by €200. In 2025, for a single person with.

Wadidaw 2025 Tax Brackets Irs Ideas 2025 CGM, The monthly salary calculator is updated with the latest income tax rates in ireland for 2025 and is a great calculator for working. Learn how to estimate your income tax with easy steps focusing on taxable income and understanding the results.

Inflationadjusted Tax Brackets for 2025 Thompson Greenspon, The ireland tax calculator below is for the 2025 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in. Every country has its own specific income tax brackets and the tax rate.

![How Tax Brackets Work [2025 Tax Brackets] White Coat Investor in 2025](https://i.pinimg.com/originals/ab/9d/c7/ab9dc7996ccf0acf5aa2a8863e024c0a.png)

How Tax Brackets Work [2025 Tax Brackets] White Coat Investor in 2025, A blended prsi rate of 4.025% has been applied to account for. Last updated on 6 february 2025 tax revenue profiles 2025.

From tomorrow, 1 january 2025, the main tax credits (personal, employee and earned income) will all increase by €100 from €1,775 to €1,875.